- Record first quarter revenue of $21.1 million, representing growth of 76% compared to the prior year period

- First quarter net loss of $(0.7) million

- First quarter Adjusted EBITDA1 of $0.4 million, our seventh consecutive positive quarter

- Project backlog of contractually committed equipment and service orders with deposits received of $22.0 million as of March 31, 2022

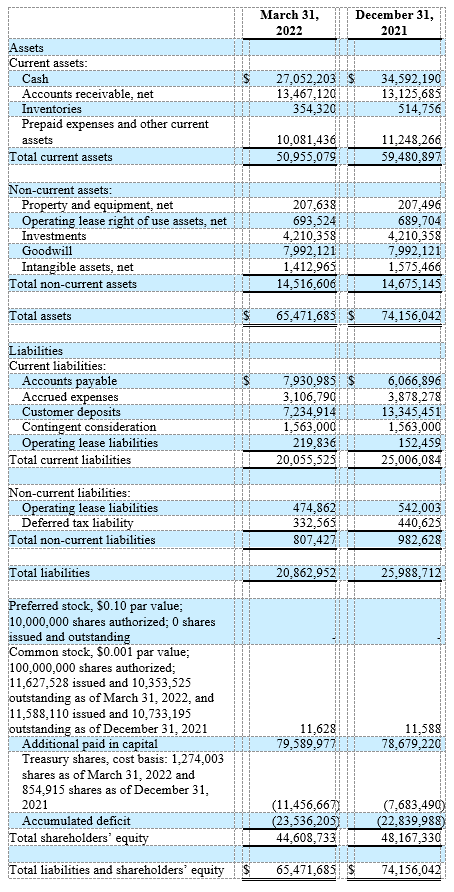

- Strong balance sheet with $27.1 million in cash and no debt

- Completed buyback of $3.8 million in treasury stock

- Company to host conference call and webcast today, May 10 at 5:30 PM ET

LAFAYETTE, Colo., May 10, 2022 – urban-gro, Inc. (Nasdaq: UGRO) (“urban-gro” or the “Company”), a fully integrated architectural design, engineering, procurement, and construction management (“EPC”) design-build firm specializing in indoor Controlled Environment Agriculture (“CEA”), today reported record first quarter financial results.

Bradley Nattrass, Chairman and CEO, commented, “We are off to a strong start in 2022, reflected by our record first quarter results, which continues to demonstrate our ability to drive unparalleled value for our clients through our full suite of in-house service offerings. We grew our revenue 75% on a year-over-year basis and continued to deliver positive Adjusted EBITDA while simultaneously making key investments that are geared toward driving long-term growth and enhancing shareholder value.”

Mr. Nattrass added, “I am very excited about the addition of construction management services to our platform following the Emerald C.M. acquisition. This completes our vision to create a turnkey design-build company with a full suite of capabilities and the requisite depth in indoor CEA expertise to drive value for our clients throughout the project lifecycle. Furthermore, while Emerald C.M. bolsters our project pipeline, our robust set of capabilities creates opportunities for diversification both in terms of revenue streams and industries beyond CEA. urban-gro is a formidable force with a focused strategy to deliver our value-added design, engineering, procurement, and construction management services through offering a bespoke design-build client solutions with a single point of responsibility.”

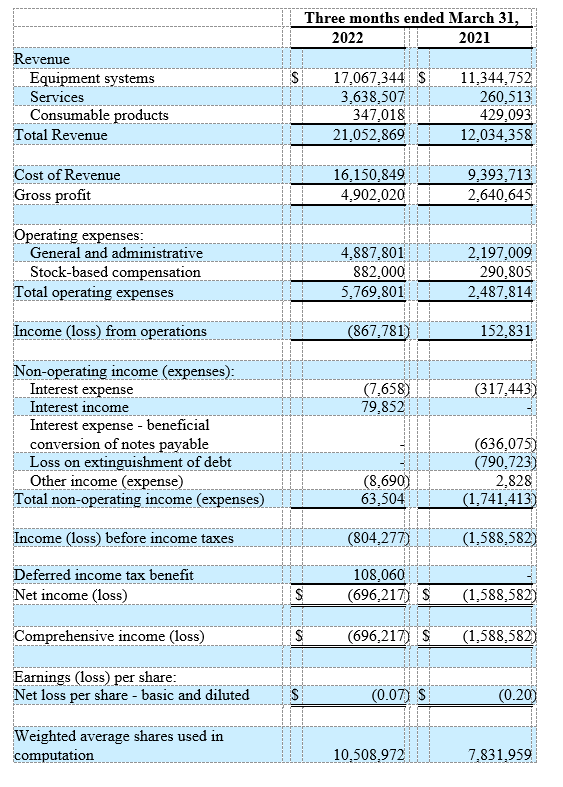

First Quarter 2022 Financial Results

Revenue was $21.1 million in the first quarter of 2022, as compared to $12.0 million in the prior year period, representing an increase of $9.1 million, or 76%. This increase was driven by an increase in the specification, procurement and integration of cultivation equipment tied to the growth of new and existing project contracts, as well as $3.4 million of incremental services revenue from acquisitions. Organic revenue growth was 48%, excluding contribution from the 2WR+ acquisition.

Gross profit was $4.9 million, or 23% of revenue, in the first quarter of 2022, as compared to $2.6 million, or 22% of revenue, in the prior year period, representing an increase of $2.3 million. The increase in gross profit dollars and margin was driven by higher margin services revenues tied to an increased focus on building out the Company’s turnkey services offering.

Operating expenses were $5.8 million in the first quarter of 2022 compared to $2.5 million in the prior year period, representing an increase of $3.3 million. This increase in operating expenses was driven primarily by increased headcount to support both current and future demand for the Company’s solutions, continued investment in European growth, as well as costs associated with acquisitions.

Net loss was $(0.7) million, or $(0.07) per share, in the first quarter of 2022, as compared to a net loss of $(1.6) million, or a net loss per share of $(0.20), in the prior year period, representing an improvement of $0.9 million, or $0.13 per share.

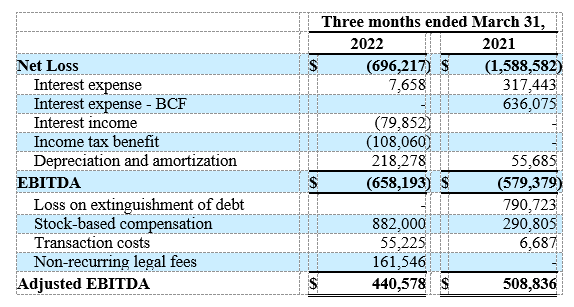

Adjusted EBITDA1 was $0.4 million in the first quarter of 2022, compared to $0.5 million in the prior year period. Adjusted EBITDA was driven by growth in gross profit, including the contribution from the acquisition of 2WR, and fully offset by strategic investments in operating expenses to drive growth.

Adjusted EBITDA is a non-GAAP financial measure. Please see the information under “Non-GAAP Financial Measures” below for a description of Adjusted EBITDA and the table at the end of this press release for a reconciliation of this non-GAAP financial measure to GAAP results.

Backlog as of March 31, 2022

Consolidated backlog is unrealized revenue represented by contractually committed equipment or service orders with deposits received. As of March 31, 2022, total backlog was $22 million, comprised of an equipment backlog of $16 million and a services backlog of $6 million.

Recent Developments

Closed Acquisition of Emerald C.M.

On April 29, 2022 the Company completed its acquisition of Emerald C.M., a 37-year-old Colorado-based construction management firm providing comprehensive construction and supervisory services, from initial design through final build-out. urban-gro is funding the purchase price of $7.0 million, inclusive of a maximum $2.0 million contingent earnout, with a combination of $2.5 million in cash and up to $4.5 million in equity. The acquisition further extends urban-gro’s full suite of in-house services to include construction management services, as well as facilitates the completion of turnkey design-build capabilities. The Company expects the acquisition to be immediately accretive to earnings in 2022.

Reiterates 2022 Revenue and Adjusted EBITDA Guidance

Excluding any unforeseen potential impact from macroeconomic forces and supply chain complexities that could affect clients and their respective industries, the Company affirmed its 2022 revenue guidance of greater than $110 million and Adjusted EBITDA guidance of greater than $5.0 million, including partial year contribution from the acquisition of Emerald C.M. Inc.

Conference Call Details

urban-gro will host a conference call and live audio webcast to discuss the operational and financial results today, May 10, 2022 at 5:30 PM ET. Interested participants and investors may access the conference call by dialing 877-407-3982 (U.S.), 201-493-6780 (International). The live webcast will be accessible on the Events page of the Investors section of the urban-gro website, ir.urban-gro.com, and will be archived for 90 days following the event.

Use of Non-GAAP Financial Information

We define Adjusted EBITDA as net income (loss) attributable to urban-gro, Inc., determined in accordance with GAAP, excluding the effects of certain operating and non-operating expenses including, but not limited to, interest expense, depreciation of tangible assets, amortization of intangible assets, impairment of investments, unrealized exchange losses, debt forgiveness and extinguishment, stock-based compensation expense, and acquisition costs that we do not believe reflect our core operating performance. We use Adjusted EBITDA as a measure of our operating performance. Adjusted EBITDA is a supplemental non-GAAP financial measure, and it is not a substitute for net income (loss), income (loss) from operations, cash flows from operating activities or any other measure prescribed by GAAP.

Our board of directors and management team focus on Adjusted EBITDA as a key performance and compensation measure. We believe that Adjusted EBITDA assists us in comparing our performance over various reporting periods because it removes from our operating results the impact of items that our management believes do not reflect our core operating performance.

There are limitations to using non-GAAP measures such as Adjusted EBITDA. Although we believe that Adjusted EBITDA can make an evaluation of our operating performance more consistent because it removes items that do not reflect our core operations, other companies in our industry may define Adjusted EBITDA differently than we do. As a result, it may be difficult to use Adjusted EBITDA to compare the performance of those companies to our performance. Adjusted EBITDA should not be considered as a measure of the income generated by our business or discretionary cash available to us to invest in the growth of our business.

Definitions:

Organic Revenue is defined as net sales excluding, when they occur, the impact of currency, acquisitions and divestitures.

About urban-gro, Inc.

urban-gro, Inc.® (Nasdaq: UGRO) is a fully integrated architectural design, engineering, procurement, and construction management (“EPC”) design-build firm specializing in indoor Controlled Environment Agriculture (“CEA”). With experience in over 500 hundred CEA projects spanning millions of square feet across the globe, we design, engineer and integrate complex environmental equipment systems into high-performance facilities. urban-gro’s gro-care® Managed Services Platform leverages the Company’s expertise to reduce downtime, provide continuity, and drive cultivation facility optimization. Operating as a full-service, a la carte and complete turn-key, design-build solutions provider in crop-agnostic indoor CEA and commercial market sectors, our end-to-end approach provides a single point of responsibility across all aspects of operations. Visit urban-gro.com to learn more.

Safe Harbor Statement

This press release contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this release, terms such as “believes,” “estimates,” “should,” “could,” “would,” “plans,” “expects,” “intends,” “anticipates,” “may,” “forecasts,” “projects” and similar expressions and variations as they relate to the Company or its management are intended to identify forward-looking statements. Such forward-looking statements are based on current expectations, forecasts, and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially from those anticipated or expected, including statements related to the demand for our services and products, our ability to manage the adverse effect brought on by the COVID-19 pandemic, our ability to execute on our strategic plans, our ability to achieve positive cash flows or profitability, our ability to achieve and maintain cost savings, the sufficiency of our liquidity and capital resources, and our ability to achieve our key initiatives for 2022. A more detailed description of these and certain other factors that could affect actual results is included in the Company’s filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as may be required by law.

The following table reconciles net loss attributable to the Company to Adjusted EBITDA for the periods presented:

urban-gro, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(unaudited)

urban-gro, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(unaudited)

Investor Contacts:

Dan Droller - urban-gro, Inc.

EVP Corporate Development & Investor Relations

-or-

Jeff Sonnek – ICR, Inc.

(720) 730-8160

investors@urban-gro.com

Media Contact:

Mark Sinclair – MATTIO Communications

(650) 269-9530