FOR IMMEDIATE RELEASE

urban-gro Announces Financial Results for 2020 Third Quarter

-

- Generated first quarterly positive Adjusted EBITDA of $0.3M in Q3 2020 versus negative $0.6M in Q3 2019;

- Net loss was $0.7M in Q3 2020 compared to $2.8M in Q3 2019;

- Revenues in Q3 increased by 50% over same period in 2019, $8.4M vs $5.6M;

- Operating Expenses decreased $3.1M, or 32%, to $6.5M YTD compared to $9.6M in the same period in 2019;

- Customer deposits against future shipments were $4.1M at the end of Q3

Lafayette, Colorado (November 3, 2020) – urban-gro, Inc. (OTCQX: UGRO) (“urban-gro” or the “Company”), a leading global horticulture company that engineers and designs proprietary indoor commercial Controlled Environment Agriculture (“CEA”) facilities and integrates complex environmental equipment systems into these high-performance facilities, announced its financial results for the quarter ended September 30, 2020.

Third Quarter Financial Summary

- The Company generated revenues of $8.4M in Q3 2020, compared to $5.6M in Q3 2019.

- On a Non-GAAP basis, Adjusted EBITDA was positive $0.3M in Q3 2020, compared to negative $0.6M in Q3 2019. This improvement was primarily the result of a reduction in operating expenses.

- This is the first period as a reporting company to report positive Adjusted EBITDA.

- The Company reported a loss from operations of $0.1M in Q3 2020, compared to a loss of $1.4M in Q3 2019.

- This decrease demonstrates the positive effect of our restructuring and cost-cutting measures that began in Q3 2019.

- Operating expenses decreased by $1.4M to $1.9M in Q3 2020 compared to $3.3M in Q3 2019.

- Net loss was $0.7M in Q3 2020 compared to a net loss of $2.8M in Q3 2019

- Loss from operations decreased by $1.3M in Q3 2020 as compared to Q3 2019.

- Total non-operating expenses decreased by $0.9M in Q3 2020 compared to Q3 2019 due primarily to reductions in interest expense, including amortization of convertible debentures, and a reduction in impairment of investment of $0.5M from Q3 2019 to Q3 2020.

- Cash on hand was $0.2M at September 30, 2020 compared to $0.4M at December 31, 2019.

- Customer deposits against future shipments were $4.1M at September 30, 2020 compared to $2.9M at December 31, 2019.

- Prepayments made to vendors for cultivation and complex equipment systems increased to $2.1M at September 30, 2020 compared to $1.3M at December 31, 2019.

Nine Month Financial Summary

- The Company generated revenues of $16.6M, compared to $17.1M in the prior year period, an overall decrease of $0.5M or 3%

- The slight decrease is primarily attributed to impact of COVID-19.

- On a Non-GAAP basis, Adjusted EBITDA was negative $0.9M, compared to negative $2.1M in the prior year period

- This $1.2M Adjusted EBITDA improvement is primarily due to reduced marketing and G&A expenses offset by a reduction in gross profit.

- Net loss was $4.0M compared to $5.7M in the prior year period due primarily to the offsetting effects of the following:

- Operating expenses decreased by $3.1M to $6.5M from $9.6M in the prior year.

- Gross profit decreased by $1.5M to $4.0M from $5.5M due to changes in the mix of revenues.

Management Commentary

“Fiscal Q3 2020 represents a pivotal quarter for the Company and is a culmination of the collaborative efforts of all employees to ensure alignment with our strategic goal of delivering leading engineering design and equipment solutions complemented by elite service levels,” notes Bradley Nattrass, Chairman and CEO of urban-gro.

“As a result of our strong sales success,” Nattrass continues, “I am pleased to report that we have re-hired more than 50% of the positions that were impacted by the COVID-19 pandemic. Together, as a cohesive team, we are excited to continue our expansion into controlled environment agriculture markets around the world.”

“Our Q3 results demonstrate that the strategic cost-cutting efforts, which began in Q3 2019 and continued throughout 2020, are showing positive results through our first quarter of positive Adjusted EBITDA,” noted Dick Akright, CFO of urban-gro. “By strictly monitoring our operating costs, our goal is to continue that trend in Q4 and into the future.”

COVID-19 Pandemic

In our opinion, the impacts of the COVID-19 pandemic to our customers’ businesses, as well as our Company, are lessening. The Company remains actively engaged with our customers, and we continue to experience an increase in customer inquiries. Projects that were on hold are starting up, and new state ballot measures are driving additional interest in engineering design services.

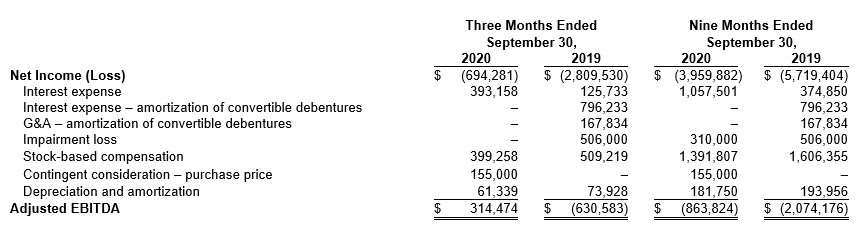

Use of Non-GAAP Financial Information

We define Adjusted EBITDA as net income (loss) attributable to urban-gro, Inc., determined in accordance with GAAP, excluding the effects of certain operating and non-operating expenses including, but not limited to, interest expense, depreciation of tangible assets, amortization of intangible assets, impairment of investments, and stock-based compensation that we do not believe reflect our core operating performance. We use Adjusted EBITDA as a measure of our operating performance. Adjusted EBITDA is a supplemental non-GAAP financial measure and it is not a substitute for net income (loss), income (loss) from operations, cash flows from operating activities or any other measure prescribed by GAAP.

Our board of directors and management team focus on Adjusted EBITDA as a key performance and compensation measure. We believe that Adjusted EBITDA assists us in comparing our performance over various reporting periods because it removes from our operating results the impact of items that our management believes do not reflect our core operating performance.

There are limitations to using non-GAAP measures such as Adjusted EBITDA. Although we believe that Adjusted EBITDA can make an evaluation of our operating performance more consistent because it removes items that do not reflect our core operations, other companies in our industry may define Adjusted EBITDA differently than we do. As a result, it may be difficult to use Adjusted EBITDA to compare the performance of those companies to our performance. Adjusted EBITDA should not be considered as a measure of the income generated by our business or discretionary cash available to us to invest in the growth of our business.

The following table reconciles net income (loss) attributable to the Company to Adjusted EBITDA for the periods presented:

About urban-gro, Inc.

urban-gro, Inc. (OTCQX: UGRO) (“urban-gro” or the “Company”) is a leading global horticulture company that engineers and designs proprietary indoor commercial Controlled Environment Agriculture (“CEA”) facilities and integrates complex environmental equipment systems into these high-performance facilities, Our custom-tailored, plant-centric approach to design, procurement, and integration provides a single point of accountability across all aspects of indoor growing operations. We also help our customers achieve operational efficiency and economic advantages through a full spectrum of professional services focused on facility optimization, and integrated pest management programs that promote environmental health. In every engagement, our unwavering focus is on solutions that ensure success. Visit www.urban-gro.com to learn more.

Safe Harbor Statement

This press release contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. When used in this release, terms such as “believes,” “estimates,” “should,” “could,” “would,” “plans,” “expects,” “intends,” “anticipates,” “may,” “forecasts,” “projects” and similar expressions and variations as they relate to the Company or its management are intended to identify forward-looking statements. Such forward-looking statements are based on current expectations, forecasts, and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially from those anticipated or expected, including statements related to the demand for our services and products, our ability to manage the adverse effect brought on by the COVID-19 pandemic, our ability to execute on our growth strategy, our ability to achieve positive cash flows, Adjusted EBITDA or profitability, our ability to achieve and maintain cost savings, the sufficiency of our liquidity and capital resources, and our ability to achieve our key initiatives for 2020. A more detailed description of these and certain other factors that could affect actual results is included in the Company’s filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as may be required by law.

For inquiries, please contact:

Investor Relations Contact:

Daniel Droller, Executive Vice President of Corporate Development

urban-gro, Inc.

Email: investors@urban-gro.com

Phone: 720-390-3880

Media Contact:

Stan Wagner

urban-gro, Inc.

Email: media@urban-gro.com

Phone: 303-618-5080